Saxo Bank review

This broker was not featured in our 2024 Broker Review Audit. This is because, in the past 12 months, it has failed to pass our initial screening process and is not recommended by our team of experts. As such some of the information found here may be out of date.

We review all brokers to a strict and unique methodology, to ensure that we only promote high quality brands that you can trust. This methodology considers over 200 criteria points, covering the categories of safety, fees, platforms, products, payments and customer support. All brokers are then given a score out of 100. We update this methodology and our recommended reviews yearly, so that you’re only given up to date information.

If a broker has a score less than 80, like this one, we won’t recommend it to you. So that we don’t waste your time, we don’t update these reviews either. We know you don’t want to read a long review of an untrustworthy broker. Instead, you can use the tool below to find a high-scoring broker that accepts clients from your country.

Brokers available in

Discover a broker you can trust by reading our in-depth and honest reviews, created by industry experts. Since 2015, we’ve reviewed over 200 forex brokers.

Saxo Bank initiated its Forex brokerage operations back in 1992 under a different brand name but has gone on to become one of the leading global brokerage houses with a substantial presence in Europe, the Middle East, and Asia-Pacific. Saxo Bank has its group offices in all prominent financial locations throughout the world, namely London, Paris, Zurich, Dubai, Sydney, Tokyo, and Singapore. Saxo Bank is primarily headquartered in Copenhagen, Denmark, and is regulated by the Danish Financial Supervisory Authority (FSA) as full-fledged Danish Bank. Saxo Bank has the distinction of being the first Forex broker in Denmark to be regulated by the Danish FSA under the new European MiFID derivatives and the guidelines prescribed by the ECB. Saxo Bank is also regulated by the ASIC of Australia, the FCA of the UK, the Banque de France, the FSC of Hong Kong, and the DFSA of Dubai, to provide one of the most reliable regulatory protections in the entire Forex trading community. The European Markets in Financial Instruments Derivatives is considered as one of the top regulatory derivatives that are designed according to the modern requirements of the financial markets, which does offer the best protection to investors and traders against financial malpractices and investor abuse. Europe witnesses the lowest instance of broker scams and financial irregularities, and are considered to be at par with other leading regulators from the US, Australia, Asia, and the Middle East.

|

|

|

Bonus |

No |

|

Regulation |

FCA |

|

Mobile |

Yes |

|

Instruments |

Forex, Precious Metals, Equity Indices, Energies |

|

Website |

www.saxobank.com |

| Not Verified | |

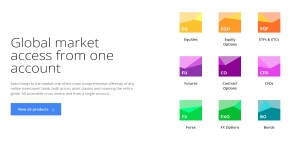

What Is The Type Of Market Access Offered To Saxo Bank Clients?

Saxo Bank is an ECN/Direct Market Access broker that connects traders to the largest liquidity providers and a global liquidity pool, where all orders are transmitted through secure ECN channels for the best trading experience. Direct market access trading is perhaps one of the most important aspects of trading, which allow traders to avoid any conflict of interest between their brokers. Direct market access not only helps in preventing any broker-related issues, but it also enables traders to get the best pricing, tight spreads, and instant order executions that are devoid of any interference from dealing desks. One of the key aspects of opening a Saxo Bank account is the access to the sheer number of financial products across a broad spectrum of capital markets. Saxo Bank works with global partners, liquidity providers, and stock exchanges to offer access to 36 different financial markets across the globe. Therefore, traders get to choose from 182 FX currency pairs, 19,000 stocks, 3,100 ETFs, 200 futures, 75 contract options, 9,000 CFDs, 29 indices, and 7000 bonds, which represent one of the largest collection of financial assets provided by a single service provider. It is difficult for any competing broker to match the number of financial products offered by Saxo Bank, which does present an opportunity for traders to indulge in a wide range of investment options according to their preferences. Traders can expect to enjoy competitive Saxo Bank spreads that are quoted at 0.2 to 2 pips across the range of currency pairs. On the flipside, ECN accounts do come with a commission per trade, which are charged according to the account balance and the volume of transactions performed by the trader on a monthly basis. Standard commission for trading includes $60 per million traded for accounts that transact less than $600 per month, which might be considered to be expensive than other ECN brokers that offer anywhere between $30 and $40 per million traded without any restrictions on the volumes trade. However, transacting a minimum of $600 per month will lower the commission to $30 per million traded, which is highly competitive. Larger traders that transact a minimum of $2000 per month and above can reduce their commission to $20 per million traded.

Are There Any Minimum Deposit Requirements For A Saxo Bank Account?

Saxo Bank’s Proprietary Trading Platforms

Have a look at our Top Rated Forex Brokers in your country:

What’s next

-

Find Your Broker We helped new traders to find their path.

-

Compare broker See what benefits one offers over the other.

-

Learn Trading financial markets has never been easier.